PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION, DATED JULY 30, 2020. SOUTH STATE CORPORATION INTENDS TO RELEASE DEFINITIVE COPIES OF THE PROXY STATEMENT ON OR ABOUT AUGUST 14, 2020.

SOUTH STATE CORPORATION

520 Gervais1101 First Street South

Columbia, South Carolina 29201Winter Haven, Florida 33880

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held April 25, 2019September 30, 2020

TO THE SHAREHOLDERS:

Notice is hereby given that the Annual Meeting of the Shareholders (the “Annual Meeting”) of South State Corporation, a South Carolina corporation (the “Company”), will be held at our headquarters in the Orangeburg Conference RoomOne Buckhead Plaza, 3060 Peachtree Road NW, Atlanta, Georgia 30305 at 10:00 a.m., local time, on the second floor, 520 Gervais Street, Columbia, South Carolina at 2:00 p.m., on April 25, 2019,September 30, 2020, for the following purposes:

(1) | To elect |

| (2) | To approve an amendment to the Company’s Articles of Incorporation to eliminate the classified structure of the Board of Directors (our Board of Directors unanimously recommends that you vote “FOR” this proposal); |

| To consider a proposal to amend and restate the Company’s Employee Stock Purchase Plan to increase the number of shares of our common stock that may be issued under the plan by up to 1,400,000 shares (our Board of Directors unanimously recommends that you vote “FOR” this proposal); |

(4) | To consider a proposal to approve the 2020 Omnibus Incentive Plan (our Board of Directors unanimously recommends that you vote “FOR” this proposal); |

| (5) | To conduct an advisory vote on the compensation of our named executive officers (this is a non-binding, advisory vote; our Board of Directors unanimously recommends that you vote “FOR” |

|

|

| To ratify, as an advisory, non-binding vote, the appointment of Dixon Hughes Goodman LLP, Certified Public Accountants, as our independent registered public accounting firm for the |

| To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

Only record holders of our common stock at the close of business on February 25, 2019,August 10, 2020, are entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof. This Proxy Statement was first mailed toAll shareholders, on or about March 8, 2019.

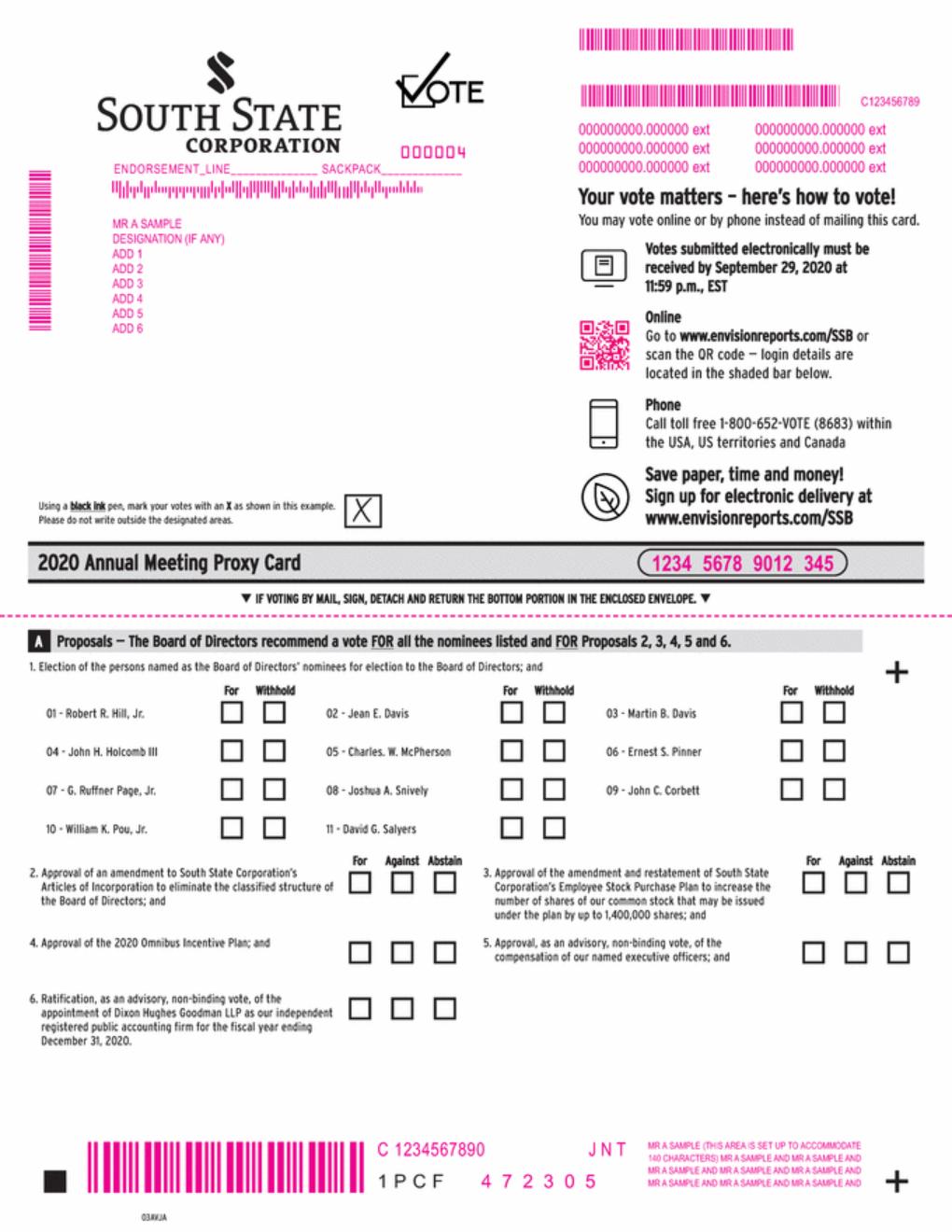

You are cordially invited and urged to attend the Annual Meeting in person. Whetherwhether or not you planthey expect to attend the Annual Meeting in person, you are requested to promptly vote by telephone, internet or telephone, or by requesting a paper proxy card and completing, signing and returning it by mail. If you attend the Annual Meeting, you may vote in person if you wish, even if you have previously voted, by revoking your proxy vote at any time prior to its exercise.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: This Proxy Statement and the Company’s 2020 Annual Report to Shareholders are available at http://www.envisionreports.com/SSB. Our Proxy Statement is attached to this Notice of Annual Meeting of Shareholders. Financial and other information concerning the Company is contained in our Annual Report on Form 10-K for the year ended December 31, 2019. On or about August 14, 2020, we began mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to shareholders of record as of August 10, 2020, and we posted our proxy materials on

the website referenced above. As more fully described in the Notice, shareholders may choose to access our proxy materials at http://www.envisionreports.com/SSB or may request a printed set of our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by e-mail on the proposals presented, following the instructionsan ongoing basis. For those who previously requested printed proxy materials or electronic materials on the Proxy Card for whichever voting methodan ongoing basis, you prefer. will receive those materials as you requested.

YOUR VOTE IS IMPORTANT. PLEASE VOTE PROMPTLY BY TELEPHONE, THE INTERNET OR BY SIGNING THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENVELOPE PROVIDED WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON IF YOU WISH, EVEN IF YOU HAVE PREVIOUSLY RETURNED YOUR PROXY.

If you vote by mail, please complete, date, sign, and promptly returnhave any questions about how to submit your proxy or voting instruction card, or if you need additional copies of this document or the enclosed proxy card or voting instruction card, you should contact our Corporate Secretary at (863) 293-4710, our or proxy solicitor, Innisfree M&A Incorporated, at (877) 717-3898 (toll-free for shareholders) or (212) 750-5833 (collect for banks and brokers).

Please vote as promptly as possible by telephone, over the Internet or by signing, dating and returning the Proxy Card.

We are monitoring the emerging public health impact of coronavirus (COVID-19). The health and safety of our shareholders, directors, officers, employees and other constituents are of paramount concern to the board of directors and management. We currently plan to hold the Annual Meeting as presented in this notice. However, if public health developments warrant, we may need to change the date, time or location of the Annual Meeting, add a virtual component to the Annual Meeting or, if permitted by applicable law, hold the Annual Meeting solely by means of remote location and not in a physical location. Any such changes will be publicly announced as promptly as practicable before the meeting by press release and posting on our website, as well as through an SEC filing. This notice also constitutes notice of any such change in the enclosed self-addressed, postage-paid envelope. If you need assistance in completing your proxy, please call the Company at 800-277-2175. If you are a record shareholder, attend the meeting, and desire to revoke your proxy and vote in person, you may do so. In any event, a proxy may be revoked by a record shareholder at any time, before it is exercised.

By Orderdate or location of the BoardAnnual Meeting and incorporates any future press releases or public filings with respect to the date, time or location of the Annual Meeting.

| |

| By Order of the Board of Directors |

| |

| /s/ Beth S. DeSimone |

| Beth S. DeSimone Corporate Secretary Winter Haven, Florida |

| August [⚫], 2020 |

/s/William C. Bochette, III

William C. Bochette, III

TABLE OF CONTENTS

| |

1 | |

2 | |

2 | |

2 | |

2 | |

3 | |

4 | |

4 | |

4 | |

5 | |

6 | |

7 | |

8 | |

16 | |

17 | |

26 | |

28 | |

PROPOSAL NO. 3: APPROVAL OF AMENDED AND RESTATED EMPLOYEE STOCK PURCHASE PLAN | 30 |

34 | |

PROPOSAL NO. 5: ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION | 41 |

42 | |

42 | |

43 | |

75 | |

78 | |

79 | |

79 | |

79 | |

80 | |

80 | |

81 |

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION, DATED JULY 30, 2020. SOUTH STATE CORPORATION INTENDS TO RELEASE DEFINITIVE COPIES OF THE PROXY STATEMENT ON OR ABOUT AUGUST 14, 2020.

520 Gervais

1101 First Street South

Columbia, South Carolina 29201

Winter Haven, Florida 33880

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

to be Held April 25, 2019September 30, 2020

This Proxy Statement is furnished to shareholders of South State Corporation, a South Carolina corporation, in connection with the solicitation of proxies by our Board of Directors, sometimes referred to herein as the Board, for use at the 2019our 2020 Annual Meeting of Shareholders to be held at our headquarters in the Orangeburg Conference RoomOne Buckhead Plaza, 3060 Peachtree Road NW, Atlanta, Georgia 30305 at 10:00 a.m., local time, on the second floor, 520 Gervais Street, Columbia, South Carolina at 2:00 p.m., on April 25, 2019September 30, 2020 or any adjournment thereof, (the “Annual Meeting”), for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. Directions to our headquarters may be obtained by contacting Rachel Miller at 803-268-9419. Unless the context indicates otherwise, all references to the “Company,” “we,” “us” and “our” in thisThis Proxy Statement referis dated August [⚫], 2020, and we are first sending the Notice of Annual Meeting and accompanying proxy materials to South State Corporation, together with its subsidiaries, including South State Bank (the “Bank”).shareholders, or sending a Notice of Internet Availability of Proxy Materials and posting the proxy materials, on or about August 14, 2020.

We will pay the cost of solicitation of proxies. Solicitation of proxies may be made in person or by mail, telephone or other means by directors, officers and regular employees of the Company.Company without receiving additional compensation. We may also request banking institutions, brokerage firms, custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of theour common stock par value $2.50 per share, of the Company held of record by such persons, and we will reimburse the reasonable forwarding expenses. We have also engaged Innisfree M&A Incorporated, a proxy solicitation firm, to solicit proxies on our behalf. We have agreed to pay Innisfree M&A Incorporated a proxy solicitation fee of $[25,000], and we will payalso reimburse them for their reasonable out-of-pocket costs and expenses.

We use the costNotice and Access rule adopted by the Securities and Exchange Commission (the “SEC”) to provide access to our proxy materials to certain shareholders over the Internet instead of solicitationmailing a printed copy of proxies. This Proxy Statement was first mailedthe proxy materials to shareholderseach shareholder. As a result, on or about March 8, 2019.August 14, 2020, we are mailing to most shareholders only a Notice of Internet Availability of Proxy Materials (the “Notice”) that tells them how to access and review the information contained in the proxy materials over the Internet and how to vote their proxies by telephone or over the Internet. If you received only this Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you request the materials by following the instructions for requesting printed copies included in the Notice.

Our principal executive offices are located at 520 Gervais1101 First Street Columbia, South, Carolina 29201. Our mailing address is P.O. Box 1030, Columbia, South Carolina 29202,Winter Haven, Florida 33880 and our telephone number is 800-277-2175.

We are monitoring the emerging public health impact of coronavirus (COVID-19). The health and safety of our shareholders, directors, officers, employees and other constituents are of paramount concern to the board of directors and management. We currently plan to hold the Annual Meeting as presented in this notice. However, if public health developments warrant, we may need to change the date, time or location of the Annual Meeting, add a virtual component to the Annual Meeting or, if permitted by applicable law, hold the Annual Meeting solely by means of remote location and not in a physical location. Any such changes will be publicly announced as promptly as practicable before the meeting by press release and posting on our website, as well as through an SEC filing. This notice also constitutes notice of any such change in the time, date or location of the Annual Meeting and incorporates any future press releases or public filings with respect to the date, time or location of the Annual Meeting.

1

OUR RECENT MERGER OF EQUALS TRANSACTION

On June 7, 2020, we completed our merger of equals transaction with CenterState Bank Corporation (“CenterState”), a Florida corporation, pursuant to the Agreement and Plan of Merger, dated as of January 25, 2020 (the “Merger Agreement”). Under the Merger Agreement, CenterState merged with and into the Company, with the Company as the surviving corporation (the “Merger”), and immediately following the Merger, South State Bank, a South Carolina banking corporation and wholly owned bank subsidiary of the Company (“South State Bank”), merged with and into CenterState Bank, N.A., a national banking association and wholly owned bank subsidiary of CenterState (“CenterState Bank”), with CenterState Bank continuing as the surviving bank (the “Bank Merger”). In connection with the Bank Merger, CenterState Bank changed its name to “South State Bank, National Association.”

Unless the context indicates otherwise, all references to the “Company,” “South State,” “we,” “us” and “our” in this Proxy Statement refer to South State Corporation, together with its subsidiaries, including South State Bank, National Association (the “Bank”). However, if the discussion relates to a period before the Bank Merger on June 7, 2020, the terms refer to South State Corporation, together with its subsidiaries, including South State Bank and references to the “Bank” refer to South State Bank.

The Annual Report to Shareholders (which includes our Annual Report on Form 10-K containing, among other things, our fiscal year ended December 31, 20182019 financial statements) accompanies this Proxy Statement. Such Annual Report to Shareholders does not form any part of the material for the solicitation of proxies.

If you are a shareholder of record returning the accompanying proxy, youYou may revoke suchyour proxy at any time prior to its exercise by:after you give it, and before it is voted, in one of the following ways:

| giving written notice to the Company of such |

| by attending the Annual Meeting and voting in person, although attendance at the |

|

|

| ● | by voting again using the telephone or Internet voting procedures. |

Your attendance at the Annual Meeting will not in itself constituteThe address to send any revocation of a proxy. Any written notice or proxy revoking a proxy should be sent tocommunications is South State Corporation, P.O. Box 1030, Columbia,1101 First Street South, Carolina 29202,Winter Haven, Florida 33880, Attention: William C. Bochette, III. Your written notice of revocationBeth S. DeSimone, Corporate Secretary.

If your broker, bank or delivery of a later dated proxyother nominee holds your shares in “street name,” you will be effective upon receipt by the Company.need to contact your broker, bank or other nominee to revoke your voting instructions.

Our only voting security is our common stock, each share of which entitles the holder to one vote on each matter to come before the Annual Meeting. At the close of business on February 25, 2019August 10, 2020 (the “Record Date”), we had issued and outstanding 35,370,054[⚫] shares of common stock, which were held of record by approximately 28,000[⚫] shareholders. Only shareholders of record at the close of business on the Record Date are entitled to notice of and to vote on matters that come before the Annual Meeting. Notwithstanding the Record Date specified above, our stock transfer books will not be closed and shares of the common stock may be transferred subsequent to the Record Date. However, all votes must be cast in the names of holders of record on the Record Date.

2

The presence in person or by proxy of the holders of a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. If a share is represented for any purpose at the Annual Meeting by the presence of the registered owner or a person holding a valid proxy for the registered owner, it is deemed to be present

2

for the purposes of establishing a quorum. Therefore, valid proxies which are marked “Abstain” or “Withhold” or as to which no vote is marked, including proxies submitted by brokers who are the record owners of shares but who lack the power to vote such shares (so‑called(so-called “broker non-votes”), will be included in determining the number of votes present or represented at the Annual Meeting. IfThe presiding officer of the Annual Meeting will determine all questions of order or procedure (and the presiding officer’s rulings will be final) and such presiding officer may, in his or her discretion, adjourn a meeting of shareholders regardless of whether a quorum is not present or represented at the Annual Meeting, the shareholders entitled to vote, present in person or represented by proxy, have the power to adjourn the Annual Meeting from time to time until a quorum is present or represented.present. If any such adjournment is for a period of less than 30 days, no notice, other than an announcement at the Annual Meeting, is required to be given of the adjournment. If the adjournment is for 30 days or more, notice of the adjourned Annual Meeting will be given in accordance with our Bylaws. Directors, officers and regular employees of the Company, in addition to our proxy solicitor, may solicit proxies for the reconvened Annual Meeting in person or by mail, telephone or other means. At any such reconvened Annual Meeting at which a quorum is present or represented, any business may be transacted that might have been transacted at the Annual Meeting as originally noticed. Once a quorum has been established, it will not be destroyed by the departure of shares prior to the adjournment of the Annual Meeting.

Provided a quorum is established at the Annual Meeting, directors will be elected by a majority of the votes cast at the Annual Meeting. Our shareholders do not have cumulative voting rights. Abstentions, broker non-votes and the failure to return a signed proxy will have no effect on the outcome of this matter.

Proposal 2, the approval of an amendment to our Articles of Incorporation to eliminate the classified structure of the Board of Directors, requires the affirmative vote of the holders of at least eighty percent (80%) of our common stock issued and outstanding as of the record date. Abstentions, broker non-votes and the failure to return a signed proxy will have the same effect as a vote against this matter.

All other matters to be considered and acted upon at the Annual Meeting require that the number of shares of common stock voted in favor of the matter exceed the number of shares of common stock voted against the matter, provided a quorum has been established. Abstentions, broker non-votes and the failure to return a signed proxy will have no effect on the outcome of such matters.

Brokers are members of the New York Stock Exchange (the “NYSE”) which allows its member-brokers to vote shares held by them for their customers on matters the NYSE determines are routine, even though the brokers have not received voting instructions from their customers. If the NYSE does not consider a matter routine, then your broker is prohibited from voting your shares on the matter unless you have given voting instructions on that matter to your broker. Because the NYSE does not consider Proposals No. 1, 2, 3, 4 and 35 to be routine matters, it is important that you provide instructions to your bank or broker if your shares are held in street name so that your vote with respect to each of these matters is counted. If you do not give your bank or broker voting instructions with respect to Proposals No. 1, 2, 3, 4 and 3,5, your bank or broker may not vote on these matters.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDER MEETING TO BE HELD ON APRIL 25, 2019

This Proxy Statement and our 2018 Annual Report to Shareholders (which includes our 2018 Annual Report on Form 10-K) are available at http://www.envisionreports.com/SSB.

ACTIONS TO BE TAKEN BY THE PROXIES

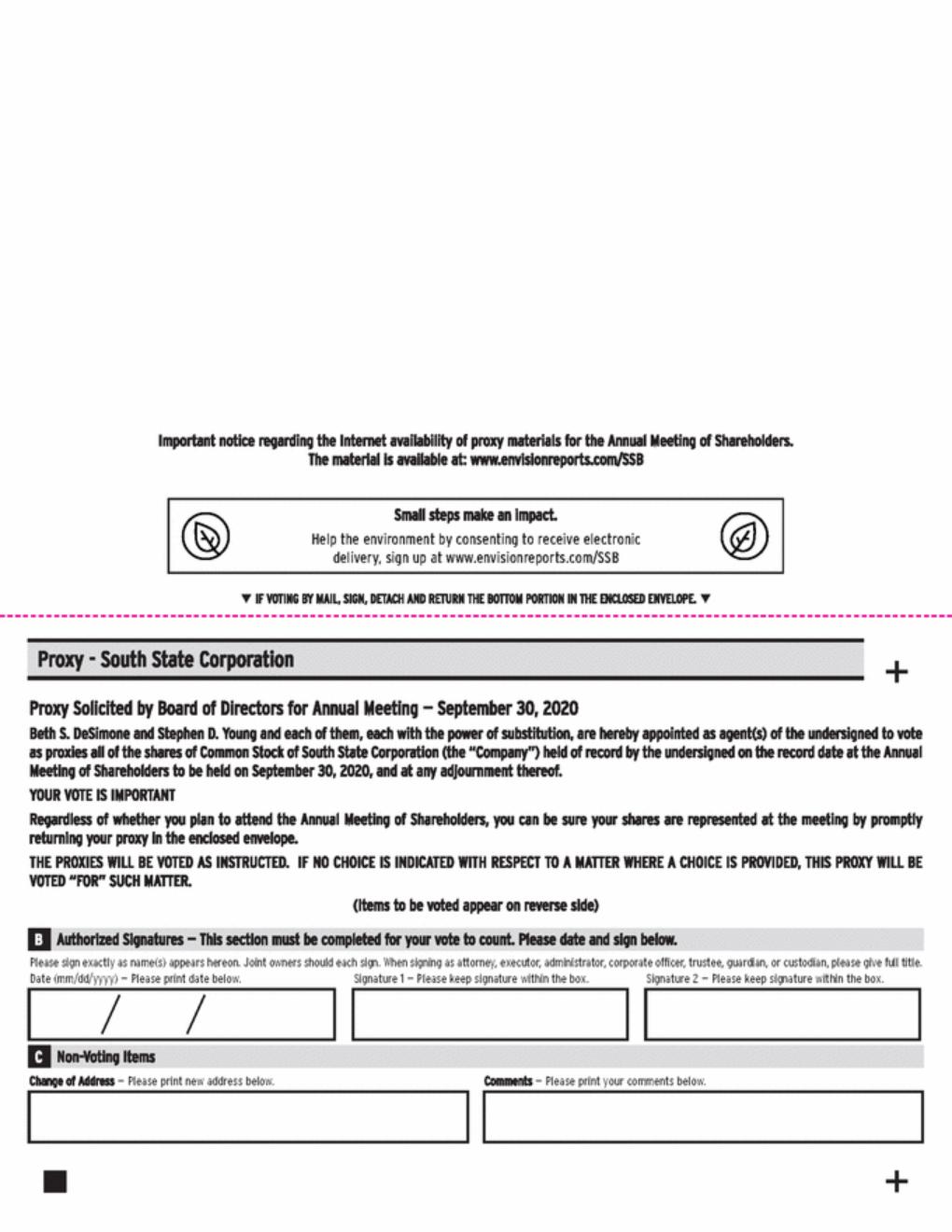

Each proxy, unless the shareholder otherwise specifies therein, will be voted according to the recommendations of the Board of Directors as follows:

Proposal One:FOR the election of the persons named in this Proxy Statement as the Board of Directors’ nominees for election to the Board of Directors; and

Proposal Two: FOR the approval of an amendment to the Company’s Articles of Incorporation to eliminate the classified structure of the Board of Directors; and

Proposal Three: FOR the proposal to amend and restate the Company’s Employee Stock Purchase Plan to increase the number of shares of our common stock that may be issued under the plan by up to 1,400,000 shares;

3

Proposal Four:FOR the approval of the 2020 Omnibus Incentive Plan;

Proposal TwoFive:FOR the approval of the compensation of our named executive officers as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission (the “SEC”), including the compensation discussion and analysis, the compensation tables and any related material disclosed in this Proxy Statement; and

Proposal Three:FOR the approval of the 2019 Omnibus Stock and Performance Plan; and

Proposal Four:Six: FOR the ratification of the appointment of Dixon Hughes Goodman LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019.2020.

In each case where you have appropriately specified how the proxy is to be voted, it will be voted in accordance with your specifications. As to any other matter of business that may be brought before the Annual Meeting, a vote may be cast pursuant to the accompanying proxy in accordance with the best judgment of the persons voting the same. However, the Board of Directors does not know of any such other business.

3

SHAREHOLDER PROPOSALSSHAREHOLDER PROPOSALS AND COMMUNICATIONS

Any shareholder of the Company desiring to include a proposal pursuant to Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”) in our 20202021 proxy statement for action at the 20202021 annual meeting of shareholders must deliver the proposal to our executive offices no later than November 10, 2019,April 16, 2021, unless the date of the 20202021 annual meeting of shareholders is more than 30 days before or after April 25,September 30, 2021 (the one year anniversary of our 2020 annual meeting of shareholders), which we anticipate to be the case, as noted below, in which case the proposal must be received a reasonable time before we begin to print and send our proxy materials. This year, our Annual Meeting, which is usually held at the end of April, was rescheduled to September 30, 2020, due to the Merger. However, we intend to resume holding our annual meetings in April beginning in 2021. Only proper proposals that are timely received and in compliance with Rule 14a-8 will be included in our 20202021 proxy statement.

Under our Bylaws, shareholder proposals not intended for inclusion in our 20202021 proxy statement pursuant to Rule 14a-8 but intended to be raised at the 20202021 annual meeting of shareholders, including nominations for election of director(s) other than the Board’s nominees, must be received no earlier than 120 days and no later than 90 days prior to the firstSeptember 30, 2021 (the one year anniversary of the 2019our 2020 annual meeting of shareholdersshareholders), unless the date of our 2021 annual meeting is more than 30 days before or more than 60 days after September 30, 2021 (the one year anniversary date of our 2020 annual meeting of shareholders), in which case the proposal must be received no later than the close of business on the later of the 90th day prior to the date of such meeting or, if the first public announcement of the date of such meeting is less than 100 days prior to the date of such meeting, then the tenth day following the date on which public announcement of the date of such meeting is first made by us), and must comply with the procedural, informational and other requirements outlined in our Bylaws. To be timely for the 2020 annual meeting of shareholders, aA shareholder proposal must be delivered to the Secretary of the Company, P.O. Box 1030, Columbia,1101 First Street South, Carolina 29202, no earlier than December 21, 2019 and no later than January 20, 2020.Winter Haven, Florida 33880.

We do not have a formal process by whichCOMMUNICATIONS WITH DIRECTORS

Under our Corporate Governance Guidelines, shareholders maythat desire to communicate with the Board, of Directors. Historically, however, the chairman of the Board or the Governance Committee has undertaken responsibility for responding to questions and concerns expressed by shareholders. In the view of the Board of Directors, this approach has been sufficient to ensure that questions and concerns raised by shareholders are adequately addressed. Any shareholder desiring to communicate with the Boarda specific individual director, may do so by writing to our Secretary or by contacting our Executive Chairman at 1101 First Street South, Winter Haven, Florida 33880. The Board has instructed the Secretary to promptly forward all such communications to the addresses indicated in such communications.

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports, or Notices Regarding the Availability of Proxy Materials, with respect to two or more shareholders sharing the same address by delivering a single proxy statement and annual report, or Notice Regarding the Availability of Proxy Materials, addressed to those shareholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for shareholders and cost savings for companies. In accordance with these rules, only one proxy statement and annual report, or Notice Regarding the Availability of Proxy

4

Materials, if applicable, will be delivered to multiple shareholders sharing an address unless we have received contrary instructions from one or more of the Companyshareholders. Shareholders who currently receive multiple copies of the proxy statement and annual report, or Notice Regarding the Availability of Proxy Materials, at P.O. Box 1030, Columbia,their address and would like to request “householding” of their communications should contact their broker if they are beneficial owners or direct their request to our Corporate Secretary at the contact information below if they are registered holders.

If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement and annual report, or Notice Regarding the Availability of Proxy Materials, please notify your broker, if you are a beneficial owner or, if you are a registered holder, direct your written request to our Corporate Secretary at the contact information below.

If requested, we will also promptly deliver, upon oral or written request, a separate copy of the proxy statement and annual report, or Notices Regarding the Availability of Proxy Materials, to any stockholder residing at an address to which only one copy was mailed. Requests for additional copies should be directed to Beth S. DeSimone at South Carolina 29202.State Corporation, 1101 First Street South, Suite 202, Winter Haven, Florida 33880, Attention: Corporate Secretary, or by telephone at (863) 293-4710, or our proxy solicitor, Innisfree M&A Incorporated, at 501 Madison Avenue, 20th Floor, New York, NY 10022, (877) 717-3898 (toll-free for shareholders) or (212) 750-5833 (collect for banks and brokers).

If you need assistance in completing your proxy card, have questions regarding the Annual Meeting, including directions to One Buckhead Plaza, or would like additional copies of the proxy materials, please contact Beth S. DeSimone at South State Corporation, 1101 First Street South, Suite 202, Winter Haven, Florida 33880, Attention: Corporate Secretary, or by telephone at (863) 293-4710, or our proxy solicitor, Innisfree M&A Incorporated, at 501 Madison Avenue, 20th Floor, New York, NY 10022, (877) 717-3898 (toll-free for shareholders) or (212) 750-5833 (collect for banks and brokers).

5

BENEFICIAL OWNERSHIP OF CERTAIN PARTIES

The following table sets forth the number and percentage of outstanding shares that exceed 5% beneficial ownership (determined in accordance with Rule 13d‑313d-3 under the Exchange Act) by any single person or group, as known by the Company based on 35,370,05470,916,898 shares of common stock issued and outstanding as of the Record Date:July 27, 2020.

|

|

|

|

|

|

|

| |||||||

| | | | | | | | |||||||

Title of Class |

| Name and Address of Beneficial Owner |

| Amount of Beneficial Ownership |

| Percent of Shares Outstanding |

|

| Name and Address of Beneficial Owner |

| Amount of Beneficial Ownership |

| Percent of Shares Outstanding |

|

Common Stock |

| The Vanguard Group |

| 3,301,846 | (1) | 9.3 | % | | The Vanguard Group | | 6,459,529 | (1) | 9.11% | |

Common Stock |

| BlackRock, Inc. |

| 2,674,522 | (2) | 7.6 | % | | BlackRock, Inc. | | 5,422,978 | (2) | 7.65% | |

Common Stock |

| Wellington Management Company LLP |

| 2,491,595 | (3) | 7.0 | % | | T. Rowe Price Associates, Inc. | | 3,554,410 | (3) | 5.01% | |

| | | | | | | | |||||||

| (1) |

| Beneficial ownership of The Vanguard Group is based on its (a) Schedule 13G/A filed with the SEC with respect to the Company on February |

| (2) |

| Beneficial ownership of BlackRock, Inc. is based on its (a) Schedule 13G/A filed with the SEC on February 6, |

|

|

| (3) | Beneficial ownership of T. Rowe Price Associates, Inc. is based on its (a) Schedule 13G filed with the SEC with respect to CenterState on February 14, 2020, in which it reported beneficial ownership of 8,972,572 shares of CenterState common stock (which represents 2,692,667 shares of our common stock after applying the 0.3001 exchange ratio in the Merger), including sole power to vote or to direct the vote of 2,140,898 shares of CenterState common stock and sole power to dispose or direct the disposition of 8,972,572 shares of CenterState common stock and (b) its Form 13F filed with the SEC on May 15, 2020 reporting sole investment discretion with respect to 1,413,512 shares of our common stock as of March 31, 2020. |

46

BENEFICIAL OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth, as of February 25, 2019,July 27, 2020, the number and percentage of outstanding shares of common stock beneficially owned by (i) each director and nominee for director of the Company, (ii) each named executive officer named inof the Summary Compensation Table,Company, and (iii) all executive officers and directors of the Company as a group. Unless otherwise indicated, the mailing address for each beneficial owner is care of South State Corporation, P.O. Box 1030, Columbia,1101 First Street South, Carolina 29202.Winter Haven, Florida 33880.

|

|

|

|

|

|

|

|

|

| Amount and Nature of Beneficial Ownership |

| ||||

Name of Beneficial Owner |

| Common Shares |

| Common Shares Subject |

| Percent of |

|

Jimmy E. Addison (6) |

| 14,727 |

| — |

| * | % |

Paula Harper Bethea (6) |

| 14,506 |

| — |

| * | % |

Renee R. Brooks (4) (6) |

| 14,992 |

| 8,705 |

| * | % |

Joseph E. Burns (5) (6) |

| 24,380 |

| 11,491 |

| * | % |

James C. Cherry |

| 8,785 |

| — |

| * | % |

Jean E. Davis (6) |

| 13,286 |

| — |

| * | % |

Martin B. Davis (6) |

| 2,570 |

| — |

| * | % |

Robert H. Demere, Jr. (3) (5) (6) |

| 97,695 |

| — |

| * | % |

Cynthia A. Hartley (6) |

| 8,157 |

| — |

| * | % |

Robert R. Hill, Jr. (6) |

| 83,373 |

| 52,398 |

| * | % |

Robert R. Horger (6) |

| 82,577 |

| 17,992 |

| * | % |

Thomas J. Johnson (6) |

| 22,895 |

| — |

| * | % |

Jonathan S. Kivett (6) |

| 8,639 |

| — |

| * | % |

Grey B. Murray (6) |

| 4,020 |

| — |

| * | % |

John C. Pollok (3) (4) (6) |

| 77,914 |

| 34,498 |

| * | % |

James W. Roquemore (3) (5) (6) |

| 46,220 |

| — |

| * | % |

Thomas E. Suggs (6) |

| 16,264 |

| — |

| * | % |

Kevin P. Walker (6) |

| 12,759 |

| — |

| * | % |

John F. Windley (4) |

| 27,131 |

| 16,379 |

| * | % |

All directors and executive officers as a group (21 persons) (4) (6) |

| 584,157 |

| 141,463 |

| 2.05 | % |

* Represents less than 1% based on 35,370,054 shares of common stock issued and outstanding. |

|

|

|

|

| ||

| | | | | | | |

| | Amount and Nature of Beneficial Ownership | | ||||

Name of Beneficial Owner |

| Common Shares |

| Common Shares Subject |

| Percent of |

|

Directors Who Were Not Named Executive Officers at Year-End 2019: | | | | | | | |

John C. Corbett | | 35,317 | | - | | 0.05* | % |

Jean E. Davis | | 15,077 | | - | | 0.02* | % |

Martin B. Davis | | 4,361 | | - | | 0.01* | % |

Robert H. Demere, Jr. | | 105,187 | | - | | 0.15* | % |

Cynthia A. Hartley | | 10,089 | | - | | 0.01* | % |

John H. Holcomb, III | | 45,869 | | - | | 0.06* | % |

Robert R. Horger | | 79,099 | | 9,370 | | 0.12* | % |

Charles W. McPherson | | 12,493 | | - | | 0.02* | % |

G. Ruffner Page, Jr. | | 188,919 | | - | | 0.27* | % |

Ernest S. Pinner | | 69,703 | | - | | 0.10* | % |

William K. Pou, Jr. | | 29,316 | | - | | 0.04* | % |

David G. Salyers | | 9,978 | | - | | 0.01* | % |

Joshua A. Snively | | 8,464 | | - | | 0.01* | % |

Kevin P. Walker | | 15,019 | | - | | 0.02* | % |

Named Executive Officers: | | | | | | | % |

Robert R. Hill, Jr. | | 109,385 | | 55,934 | | 0.23* | % |

Renee R. Brooks | | 24,042 | | 12,520 | | 0.05* | % |

Greg A. Lapointe | | 17,795 | | 5,540 | | 0.03* | % |

John S. Goettee | | 20,673 | | 5,540 | | 0.04* | % |

John C. Pollok | | 96,175 | | 28,539 | | 0.18* | % |

| | | | | | | |

All directors and executive officers as a group (19 persons) (4) (6) | | 896,961 | | 117,443 | | 1.43 | % |

* Represents less than 1% based on 70,916,898 shares of common stock issued and outstanding. | | | | | | | |

| (1) |

| As reported to the Company by the directors, nominees and executive officers. |

| (2) |

| Based on the number of shares of common stock acquirable by directors and executive officers through vested stock options within 60 days of |

| (3) |

| Excludes shares of common stock owned by or for the benefit of family members of the following directors and executive officers, each of whom disclaims beneficial ownership of such shares: Mr. Pollok, 666 shares; Mr. |

| (4) |

| Includes shares of common stock held as of December 31, |

| (5) |

| For Mr. Demere, includes 52,257 shares of common stock owned by Colonial Group, Inc., of which Mr. Demere is President and Chief Executive Officer. |

| (6) | Includes 815 shares of unvested restricted stock owned by |

|

|

57

PROPOSAL NO. 1: ELECTION OF DIRECTORS

Our Articles of Incorporation provide for a maximum of 20 directors;directors, to be divided into three classes with each director serving a three-year term, with the classes as equal in number as possible. OurThe current term of our Class I directors will expire at this year’s annual meeting.

As noted above, we completed our previously announced Merger with CenterState on June 7, 2020. In connection with the Merger and in accordance with the Merger Agreement, our bylaws were amended to reflect certain governance arrangements for the combined company (such amendment, the “Bylaws Amendment,” and our bylaws, as amended and restated in accordance with the Bylaws Amendment, the “Bylaws”), effective as of the effective time of the Merger (the “Effective Time”).

Under our Bylaws, the size of our Board of Directors has currently establishedas of the Effective Time was increased from 14 to 16 directors, including eight directors designated by the Company and eight directors designated by CenterState. The Bylaws Amendment provides that from and after the Effective Time and until the 36 month anniversary of the Effective Time (the “Specified Period”), the number of directors at 15.

Robert R. Horger, Robert H. Demere, Jr., Grey B. Murray,that comprises the entire Board of Directors will be 16 and James W. Roquemore,any vacancy on the Board created by the cessation of service for any reason by (a) a Legacy South State Director will be filled by the Board with a nominee selected by a committee of the Board comprised of all of whom currently arethe Legacy South State Directors who satisfy certain independence and other requirements, and (b) a Legacy CenterState Director will be filled by the Board with a nominee selected by a committee of the Board comprised of all of the Legacy CenterState Directors who satisfy certain independence and other requirements. In this Proxy Statement, “Legacy South State Directors” and “Legacy CenterState Directors” refer to, respectively, the directors of South State and CenterState who were selected to be directors of the Company by South State or CenterState, as the case may be, as of the Effective Time, pursuant to the Merger Agreement, and whoseany directors of the Company who are subsequently nominated and elected to fill a vacancy created by the cessation of service of a Legacy South State Director or Legacy CenterState Director, respectively, pursuant to the Bylaws Amendment.

Our Bylaws provide that directors may not be over 72 years of age at the time of the shareholders’ meeting at which they are elected. However, pursuant to the Bylaws Amendment, this provision will be deemed waived with respect to the individuals initially serving as Legacy South State Directors or Legacy CenterState Directors, as applicable, as of the Effective Time, and the Board may further waive such requirement for one or more directors if it determines that doing so is in our and our shareholders’ best interests.

Under South Carolina law and our Bylaws, the term of a director appointed to fill a vacancy, including a vacancy resulting from an increase in the number of directors, expires at the next shareholders’ meeting at which directors are elected. Accordingly, the term of each of the Legacy CenterState Directors, who were appointed as directors as of the Effective Time, expires at the 2020 Annual Meeting. Once elected by the shareholders, each such director will serve until the expiration of the term of the class to which he or she was appointed. Accordingly, once elected by the shareholders, the terms for the Class I directors, Class II directors and Class III directors will expire at the annual shareholder meeting held in 2023, 2021 and 2022, respectively.

However, as discussed under Proposal No. 2 (Approval of an Amendment to our Articles of Incorporation to Eliminate the Classified Board Structure), in the event that the Declassification Amendment is approved by our shareholders, each director currently serving as a Class I or Class II director, and each director nominated by the Board in this Proxy Statement for election at the Annual Meeting have been nominated by ourto serve as a Class I or Class II director, will be expected to tender his or her resignation following the 2020 Annual Meeting if he or she is a member of the Board of Directors for re-electionat that time. Each such Class I and Class II director (including the Class I and Class II director nominees should they be elected at the Annual Meeting) will subsequently be reappointed to the declassified Board by the shareholders. If re-elected, Messrs. Horger, Demere, Murray and Roquemoreremaining members of the Board, such that each member of the Board will serve as directors ofa one-year term following the CompanyAnnual Meeting and stand for a three-year term, expiringelection annually, beginning at the 2022our 2021 annual meeting of shareholders, in the event that the Declassification Amendment is approved by our shareholders.

8

Director Nominees

Jimmy E. Addison, a director since 2007, will retire effective as of the Annual Meeting. The Board of Directors has determined not to fill the vacancy caused by Mr. Addison’s retirement at this time. Therefore, effective as of theAt our Annual Meeting, the Boardyou will be reducedasked to 14 directors. Mr. Addison has served as avote for the election of eleven director ofnominees to serve for the Company since 2007. We appreciate Mr. Addison’s contribution to the Company during his service as a director.

terms specified below. The Board of Directors unanimously recommends that shareholders vote “FOR” the director nominees.

The tabletables below setsset forth for each director’sdirector nominee his or her name, age, year when first elected and year their current term expiration,expires, business experience for at least the past five years, and the qualifications that led to the conclusion that the individual should serve as a director.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First |

| Current |

| Nominee |

|

|

|

|

|

|

| Elected |

| Term |

| for New |

| Business Experience for the Past Five Years and |

|

Name |

| Age |

| Director |

| Expires |

| Term |

| Director Qualifications |

|

Robert R. Horger Chairman South State Bank Employee |

| 68 |

| 1991 |

| 2019 |

| ● |

| Mr. Horger has served as Chairman of the Company and the Bank since 1998. He also has served as Vice Chairman of the Company and the Bank, from 1994 to 1998. Mr. Horger has been an attorney with Horger, Barnwell and Reid in Orangeburg, South Carolina, since 1975. During his tenure as Chairman, Mr. Horger has developed knowledge of our business, history, organization, and executive management which, together with his personal understanding of many of the markets that we serve, has enhanced his ability to lead the Board of Directors through varying business environments for financial institutions. Mr. Horger’s legal training and experience enhance his ability to understand our regulatory framework. |

|

Robert R. Hill, Jr. Chief Executive Officer South State Bank Employee |

| 52 |

| 1996 |

| 2020 |

|

|

| Mr. Hill has served as Chief Executive Officer of the Company since November 6, 2004. Mr. Hill also served as President of the Company from November 6, 2004 to July 26, 2013. Prior to that time, Mr. Hill served as President and Chief Operating Officer of South State Bank, from 1999 to November 6, 2004. Mr. Hill joined us in 1995. He was appointed to serve on the Federal Reserve Board of Directors in December 2010. Mr. Hill brings to the Board an intimate understanding of our business and organization, as well as substantial leadership ability, banking industry expertise, and management experience. |

|

John C. Pollok Chief Financial Officer South State Bank Employee |

| 53 |

| 2012 |

| 2021 |

|

|

| Mr. Pollok has served as Chief Financial Officer since March 21, 2012 and as Chief Operating Officer of the Company from February 15, 2007 until July 19, 2018. Mr. Pollok also previously served as the Chief Operating Officer of the Bank from February 15, 2007 until March 21, 2012. Prior to that time, Mr. Pollok served as the Chief Financial Officer of the Company from February 15, 2007 until January 3, 2010. Mr. Pollok brings to the Board an overall institutional knowledge of our business, banking industry expertise, and leadership experience. |

|

| | | | | | | | | | |

Class I Director Nominees to Serve a Three-Year Term Expiring at Our 2023 Annual Meeting | | |||||||||

| | | | | | Current | | | | |

| | | | Director | | Term | | | Business Experience for the Past Five Years and | |

Name |

| Age |

| Since |

| Expires | |

| Director Qualifications |

|

Robert R. Hill, Jr. Executive Chairman | | 53 | | 1996 | | 2020 | | | Mr. Hill was appointed as our Executive Chairman on June 7, 2020 in connection with the Merger. Before that, he served as Chief Executive Officer of the Company from November 6, 2004 to June 7, 2020. Mr. Hill also served as President of the Company from November 6, 2004 to July 26, 2013. Before that, Mr. Hill served as President and Chief Operating Officer of South State Bank, from 1999 to November 6, 2004. Mr. Hill joined us in 1995. He was appointed to serve on the Board of Directors of the Federal Reserve Bank of Richmond in December 2010, and since 2019, has served on the Board of Directors of Sonoco Products Company. Mr. Hill brings to our Board an intimate understanding of our business and organization, as well as substantial leadership ability, banking industry expertise, and management experience. | |

Jean E. Davis | | 64 | | 2017 | | 2020 | | | Ms. Davis, former Park Sterling Corporation Board member, retired as the head of Operations, Technology and e-Commerce of Wachovia Corporation in 2006. She previously served as the Head of Operations and Technology, Head of Human Resources, Head of Retail Banking, and in several other executive, regional executive and corporate banking roles for Wachovia. Ms. Davis brings to our Board extensive knowledge of bank operations and technology, as well as human resources, which are important to our long-term success. In addition, she brings a strong background in retail banking, merger due diligence and merger integration experience. | |

69

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First |

| Current |

| Nominee |

|

|

|

|

|

|

| Elected |

| Term |

| for New |

| Business Experience for the Past Five Years and |

|

Name |

| Age |

| Director |

| Expires |

| Term |

| Director Qualifications |

|

Jimmy E. Addison |

| 58 |

| 2007 |

| 2019 |

|

|

| Mr. Addison served as Chief Executive Officer of SCANA Corporation, until the merger with Dominion Energy which closed on January 1, 2019. He retired on February 1, 2019. He previously served as its Chief Financial Officer from 2006 through 2017 and as President of SCANA Energy from 2014 through 2017. Mr. Addison also serves as a member of the board (past president) for the Business Partnership Foundation of the Darla Moore School of Business at the University of South Carolina. He is a licensed CPA and previously worked for an international accounting firm. His leadership experience, knowledge of financial reporting requirements of public companies, and business and personal ties to many of the Bank’s market areas enhance his ability to contribute as a director. |

|

Paula Harper Bethea Vice Chairman |

| 63 |

| 2013 |

| 2020 |

|

|

| Mrs. Bethea has served as Vice-Chairman of the Board of Directors of the Company and the Bank since 2013. She is currently President of Strategic Synergies LLC and President of Dillon Property Holdings LLC. Mrs. Bethea was formerly the Executive Director of the South Carolina Education Lottery and was one of nine South Carolinians chosen in 2001 to establish the Lottery. Prior to this position, Mrs. Bethea was with the McNair Law Firm from 2006 to 2009 where she served as Director of External Relations. Mrs. Bethea served on the board of directors of former First Financial Holdings, Inc. (“FFHI”) of Charleston, South Carolina from 1996 until it merged with the Company in 2013. Her business and personal experience in certain of the communities that the Bank serves provides her with an appreciation of markets that we serve, and her leadership experiences provide her with insights regarding organizational behavior and management. |

|

James C. Cherry |

| 68 |

| 2017 |

| 2020 |

|

|

| Mr. Cherry served as the Chief Executive Officer and as a director of Park Sterling Corporation from its formation in 2010 until November 2017 when it merged with the Company. Mr. Cherry has served as a consultant to the Bank since November 2017. He retired as the Chief Executive Officer for the Mid-Atlantic Banking Region at Wachovia Corporation in 2006, and previously served as President of Virginia Banking, Head of Trust and Investment Management, and in various positions in North Carolina and Virginia banking including Regional Executive, Area Executive, City Executive, Corporate Banking and Loan Administration Manager, and Retail Banking Branch Manager for Wachovia. He is currently a director of Armada Hoffler Properties Inc. (NYSE: AHH), a Virginia-based publicly traded real estate company; Beach Community Bank, a Fort Walton, Florida based commercial bank; and, Manga Imperio Systems Corporation, a Houston, Texas based water purification company. Mr. Cherry’s extensive experience in commercial and retail banking operations, credit administration, product management and merger integration at Wachovia and Park Sterling Bank, which was focused in the Carolinas and Virginia, provides the Board with significant expertise important to the oversight of the Company and expansion into our target markets. |

|

Martin B. Davis | | 56 | | 2016 | | 2020 | | | Mr. Davis is Executive Vice President of Southern Company Services and Chief Information Officer of Southern Company. Mr. Davis has spent nearly 30 years leading complex technology organizations in highly regulated environments. Mr. Davis serves on the American Heart Association’s South East Region Board of Directors. Mr. Davis also served on the Board of Trustees of Winston-Salem State University. He has been recognized as one of the “50 Most Important African-Americans in Technology” by U.S. Black Engineers & Information Technology magazine and one of the “75 Most Powerful African-Americans in Corporate America” by Black Enterprise. Mr. Davis’ technology-related experience provides our Board with useful insight regarding this area of increasing strategic importance to bank marketing and operations. | |

John H. Holcomb III | | 69 | | 2020 | | 2020 | | | Mr. Holcomb was appointed to our Board of Directors on June 7, 2020 in connection with the Merger. He retired as Vice Chair of the National Commerce Bancorporation (NCOM) upon NCOM’s merger with CenterState on April 1, 2019, after serving as Executive Chair of the NCOM Board from May 2017 to April 1, 2019, and as an NCOM Board member from 2018 to April 1, 2019. He previously served as Chief Executive Officer of NCOM and as Chair of the NCOM and National Bank of Commerce (“NBC”) Boards from October 2010 to May 2017. From October 2010 until June 2012, Mr. Holcomb also served as Chief Executive Officer of NBC. Mr. Holcomb previously served as Chairman of the board of directors and Chief Executive Officer of Alabama National BanCorporation from 1996 until it was acquired in 2008, and then as Vice Chairman of RBC Bank (USA) until June 2009. Mr. Holcomb’s long experience as a leading banker in the markets where we currently operate provides our Board with valuable knowledge, particularly as it relates to the correspondent banking business. | |

710

Charles W. McPherson | | 72 | | 2020 | | 2020 | | | Mr. McPherson was appointed to our Board of Directors on June 7, 2020 in connection with the Merger, and he serves as our lead independent director. He is a retired executive with 38 years of experience as a senior level banking executive in Central Florida. Mr. McPherson served as Chairman, President and Chief Executive Officer of SunTrust Bank, Mid-Florida, a $1.5 billion bank with 26 branches in Central Florida between 1988 and 2008. Previously, he was the Chairman, President and Chief Executive Officer of Sun First National Bank of Polk County (1986 – 1988); Group President of Sun First National Bank of Polk County (1984 – 1986); Chairman, President and Chief Executive Officer of Flagship State Bank of Polk County (1979 – 1984); and Executive Vice President of Flagship Bank of Okeechobee (1974 – 1979). Mr. McPherson’s extensive experience provides our Board with in-depth insight from both the perspective of our industry and its evolution, as well as from the perspective of the primary markets that we serve. | |

Ernest S. Pinner | | 72 | | 2020 | | 2020 | | | Mr. Pinner was appointed to our Board of Directors on June 7, 2020 in connection with the Merger. He previously served as the Chairman of the board of directors of CenterState from January 1, 2020 until the Merger, and as Executive Chairman of the board of directors of CenterState from July 2015 until January 1, 2020. Before that, he served as President and Chief Executive Officer of CenterState. Mr. Pinner has been actively involved in the banking business in Central Florida over the past 50 years. Mr. Pinner was also the Chairman of CenterState’s subsidiary bank. He was the founding President and Chief Executive Officer of CenterState Bank, N.A., which was acquired by CenterState in 2002. He was a director of CenterState Bank MidFlorida, N.A., which was acquired by CenterState in 2006. Before joining CenterState in 1999, he had a lengthy career with First Union Bank and was the area President and Senior Vice President of First Union National Bank between 1986 and 1999. Mr. Pinner brings to our Board a lifetime of banking experience at all levels of a financial institution (both regional and community banking). | |

11

| | | | | | | | | | |

Class III Director Nominees to Serve a Two-Year Term Expiring at Our 2022 Annual Meeting | | |||||||||

| | | | | | Current | | | | |

| | | | Director | | Term | | | Business Experience for the Past Five Years and | |

Name |

| Age |

| Since |

| Expires | |

| Director Qualifications |

|

G. Ruffner Page, Jr. | | 60 | | 2020 | | 2020* | | | Mr. Page was appointed to our Board of Directors on June 7, 2020 in connection with the Merger. He is the President of McWane, Inc., a company involved in the manufacture of pipes, valves, water fittings, fire extinguishers and propane tanks and in various technology industries, since 1999. Mr. Page previously served on the NCOM Board from 2010 to April 2019, before it was acquired by CenterState, and was its lead independent director. Mr. Page previously served as Executive Vice President of National Bank of Commerce, a subsidiary of Alabama National Bancorporation, from 1989 until 1994, after which time he accepted employment at McWane, Inc. Mr. Page also served on the board of directors of Alabama National BanCorporation from 1995 until it was acquired in 2008. Mr. Page’s experience as the President of one of the largest privately-owned manufacturing companies in the U.S. and understanding of banking as a former financial institution executive provides our Board with valuable strategic insights as we continue to evolve into a leading Southeast regional community bank. | |

Joshua A. Snively | | 55 | | 2020 | | 2020* | | | Mr. Snively was appointed to our Board of Directors on June 7, 2020 in connection with the Merger. He is President of ADM Global Citrus Platform and President of Florida Chemical Company, LLC. ADM acquired Florida Chemical from Flotek Industries, Inc. (Flotek) in March 2019. ADM (NYSE: ADM) is a global leader in human and animal nutrition and the world’s premier agricultural origination and processing company. Prior to the acquisition, Mr. Snively was Executive Vice President of Operations for Flotek and President of its wholly owned subsidiary, Florida Chemical Company, Inc. Mr. Snively has been with Florida Chemical since 1995 and was instrumental in transforming the company from a family-owned and operated business to a professionally managed operation with an independent board of directors. Prior to joining Florida Chemical, Mr. Snively was Vice President of Commercial Agriculture Finance at SunTrust Bank and was a commercial lender for Farm Credit of Central Florida. He graduated with a B.S. in Finance and Citrus Management from Florida Southern College. Mr. Snively is also a Director of the Citrus Development and Research Foundation. Mr. Snively’s commercial finance experience and his understanding of family owned businesses provides valuable insight our Board as we continue to develop our lending strategy and policy. | |

12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First |

| Current |

| Nominee |

|

|

|

|

|

|

| Elected |

| Term |

| for New |

| Business Experience for the Past Five Years and |

|

Name |

| Age |

| Director |

| Expires |

| Term |

| Director Qualifications |

|

Jean E. Davis |

| 63 |

| 2017 |

| 2020 |

|

|

| Ms. Davis, a former Park Sterling Corporation board member, retired as the head of Operations, Technology and e-Commerce of Wachovia Corporation in 2006. She previously served as the Head of Operations and Technology, Head of Human Resources, Head of Retail Banking, and in several office executive, regional executive and corporate banking roles for Wachovia. She is currently a member of the Board of Safe Alliance, Charlotte, North Carolina and of the Charlotte Latin School. Ms. Davis brings extensive knowledge of bank operations and technology, as well as human resources, to the Board of Directors, both of which are important to our long-term success. In addition, she brings a strong background in retail banking, merger due diligence and merger integration experience. |

|

Martin B. Davis |

| 55 |

| 2016 |

| 2020 |

|

|

| Mr. Davis is Executive Vice President of Southern Company Services and Chief Information Officer of Southern Company (NYSE: SO) and has served in this position since July 2015. Prior to this time, Mr. Davis was the head of Enterprise Technology Services, Chief Technology Officer, and Executive Vice President with Wells Fargo from 2008 through 2014. Mr. Davis has spent over 30 years leading complex technology organizations in highly regulated environments. Mr. Davis serves on the American Heart Association’s Mid-Atlantic region board of directors. Mr. Davis served on the board of trustees at Winston-Salem State University. He has been recognized as one of the “50 Most Important African-Americans in Technology” by U.S. Black Engineers & Information Technology magazine and one of the “75 Most Powerful African-Americans in Corporate America” by Black Enterprise. Mr. Davis’ technology-related experience provides him with useful insight regarding this area of increasing strategic importance to bank marketing and operations. |

|

Robert H. Demere, Jr. |

| 70 |

| 2012 |

| 2019 |

| ● |

| Mr. Demere serves as Chairman and Chief Executive Officer of Colonial Group, Inc., a petroleum marketing company located in Savannah, Georgia. Mr. Demere has been employed by Colonial Group, Inc. since 1974. As the former President of Colonial Group, Inc., Mr. Demere has attained valuable experience in raising equity in the capital markets. Prior to working for Colonial, Mr. Demere worked as a stockbroker for Robinson-Humphrey Company. Mr. Demere served on the board of directors of Savannah Bancorp Inc. from 1989 until we acquired it in 2012. His business and personal experience in certain of the communities that the Bank serves also provides him with an appreciation of and useful insight regarding certain markets that we serve. |

|

Cynthia A. Hartley |

| 70 |

| 2011 |

| 2021 |

|

|

| Mrs. Hartley retired in 2011 as Senior Vice President of Human Resources with Sonoco Products Company in Hartsville, South Carolina. Mrs. Hartley served as the Chairman of the Board of Trustees for Coker College in Hartsville, South Carolina. Mrs. Hartley was first elected to our Board of Directors in May of 2011. Her leadership experience, knowledge of human resource matters, and business and personal ties with many of the Bank’s market areas enhance her ability to contribute as a director. |

|

| | | | | | | | | | |

Class II Director Nominees to Serve a One-Year Term Expiring at Our 2021 Annual Meeting | | |||||||||

| | | | | | Current | | | | |

| | | | Director | | Term | | | Business Experience for the Past Five Years and | |

Name |

| Age |

| Since |

| Expires | |

| Director Qualifications |

|

John C. Corbett Chief Executive Officer of the Company and President and Chief Executive Officer of the Bank | | 51 | | 2020 | | 2020* | | | Mr. Corbett was appointed as the Chief Executive Officer of the Company, the President and Chief Executive Officer of South State Bank, and to our Board of Directors on June 7, 2020 in connection with the Merger. Before that, he served as the President and Chief Executive Officer of CenterState since July 2015 and was its Executive Vice President from 2007 to 2015. He also served as the Chief Executive Officer and as a director of CenterState Bank, N.A., now known as South State Bank (2003 to present) and was CenterState Bank, N.A.’s Executive Vice President and Chief Credit Officer from 2000 to 2003. Prior to joining CenterState Bank, N.A. in 1999, he was Vice President of Commercial Banking at First Union National Bank in Florida (1990 to 1999). Mr. Corbett, as a founding leader of CenterState, brings to our Board a strong historical perspective and working knowledge of CenterState, which we believe will contribute considerable value as part of our deliberations and decision-making process. | |

William K. Pou, Jr. | | 63 | | 2020 | | 2020* | | | Mr. Pou was appointed to our Board of Directors on June 7, 2020 in connection with the Merger. He is the Chairman of the board, Executive Vice President and Chairman of the Compliance Committee of W.S. Badcock Corporation (dba Badcock Home Furniture & More), where he is responsible for the retail operations of over 373 stores in eight states throughout the Southeastern United States. Mr. Pou has spent his entire adult life with this organization and has been involved in all aspects of its operations including the consumer credit division as well as personally owning and operating several stores between 1979 and 1998 as an independent dealer. He was also a founding director of the First National Bank of Polk County in 1992, one of the initial three banks which were merged together to form CenterState. Mr. Pou serves on the Boards of Trustees of Florida Southern College in Lakeland, Florida and Lakeland Regional Health. Mr. Pou brings to our Board more than 30 years of experience and insight in consumer credit and collections, as well as experience and knowledge in operating multi-unit, multi-state operations. | |

813

David G. Salyers | | 61 | | 2020 | | 2020* | | | Mr. Salyers was appointed to our Board of Directors on June 7, 2020 in connection with the Merger. He is retired as the executive responsible for growth and hospitality for Chick-fil-A, Inc., the Atlanta based fast food restaurant chain, where he spent his entire 37-year career. He also is active in community activities, and has been involved in venture capital partnerships and technology ventures, as well as serves on various boards of several start up organizations. He was recently hired by the University of Georgia to be the Inaugural Start Up Mentor-In-Residence. Mr. Salyers is the author of the book, “Remarkable!” on company culture. Mr. Salyers is also a former director of Live Oak Bancshares and its subsidiary, Live Oak Banking Company, Wilmington, North Carolina. Mr. Salyers’ experience in operating a national service-oriented business and leadership development is considered a valuable asset to our Board as we continue to evolve into a leading Southeast regional community bank with a focus on our customer and employees and developing a distinctive and welcoming culture. | |

* | Under South Carolina law and our Bylaws, the term of a director appointed to fill a vacancy, including a vacancy resulting from an increase in the number of directors, expires at the next shareholders’ meeting at which directors are elected. Accordingly, the term of each of the Legacy CenterState Directors, who were appointed as directors as of the Effective Time, expires at the Annual Meeting. Once elected by the shareholders, each such director will serve until the expiration of the term of the class to which he or she was appointed. Accordingly, once elected by the shareholders, the terms for the Class I directors, Class II directors and Class III directors will expire at the annual shareholder meeting held in 2023, 2021 and 2022, respectively, in each case subject to approval by our shareholders of the Declassification Amendment and implementation of the Accelerated Declassification Plan discussed under Proposal No. 2 below. |

The Board of Directors unanimously recommends that shareholders vote “FOR” each of the above-referenced director nominees.

14

Continuing Directors

The table below sets forth for each continuing director’s name, age, year when first elected and year when their current term expires, business experience for at least the past five years, and the qualifications that led to the conclusion that the individual should serve as a director.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First |

| Current |

| Nominee |

|

|

|

|

|

|

| Elected |

| Term |

| for New |

| Business Experience for the Past Five Years and |

|

Name |

| Age |

| Director |

| Expires |

| Term |

| Director Qualifications |

|

Thomas J. Johnson |

| 68 |

| 2013 |

| 2020 |

|

|

| Mr. Johnson is President, Chief Executive Officer, and Owner of F&J Associates, a company that owns and operates automobile dealerships in the southeastern United States and the U.S. Virgin Islands. He serves on the Board of Directors of the South Carolina Automobile Dealers Association, the Board of Visitors of the Coastal Carolina University School of Business and the South Carolina Business Resources Board. Mr. Johnson served on the board of directors of FFHI from 1998 until it merged with us in 2013. Mr. Johnson’s extensive business experience and knowledge of markets that we serve enhance his ability to contribute as a director. |

|

Grey B. Murray |

| 53 |

| 2017 |

| 2019 |

| ● |

| Mr. Murray, a former Georgia Bank & Trust board member, has served as President of United Brokerage Company, Inc., headquartered in Augusta, Georgia since 1991. Mr. Murray also serves as a Commissioner on the Augusta Aviation Commission and is a graduate of Leadership Georgia. An active member of the community, Mr. Murray has served on the board of directors of the American Heart Association, University Health Care Foundation, Augusta Country Club, Secession Golf Club, St. Paul’s Building Authority, Exchange Club of Augusta, Georgia Movers Association, and Augusta Preparatory Day School (past Chairman of the Board). Mr. Murray’s extensive business experience and knowledge of markets that we serve enhance his ability to contribute as a director. |

|

James W. Roquemore |

| 64 |

| 1994 |

| 2019 |

| ● |

| Mr. Roquemore had served as Chief Executive Officer of Patten Seed Company, Inc. of Lakeland, Georgia, and General Manager of Super-Sod/Carolina, a company that produces and markets turf, grass, sod and seed, since 1997. As the Chief Executive Officer of a company, Mr. Roquemore has experience with management, marketing, operations, and human resource matters. His business and personal experience in the communities that the Bank serves also provides him with an appreciation of markets that we serve. Moreover, during his tenure as a director he has developed knowledge of our business, history, organization, and executive management which, together with the relationships that he has developed, enhance his leadership and consensus-building ability. |

|

Thomas E. Suggs |

| 69 |

| 2001 |

| 2021 |

|

|

| Mr. Suggs has served as President and Chief Executive Officer of HUB Carolinas, a region of HUB International, the eighth largest insurance broker in the world, since August 2016. Mr. Suggs was the President and Chief Executive Officer of Keenan & Suggs, Inc., an insurance brokerage and consulting firm, before it was acquired by HUB International in August 2016. Mr. Suggs has over 23 years of experience in the insurance industry and 25 years of banking experience. As the chief executive officer of the HUB Carolinas region, Mr. Suggs has experience with management, marketing, operations, and human resource matters, and his experience with the banking industry also provides him with certain insights. His business and personal experience in communities that the Bank serves also provides him with an appreciation of markets that we serve. |

|

| | | | | | | | | | ||||||||

| | | | | | Current | | | | ||||||||

| | | | Director | | Term | | Business Experience for the Past Five Years and | | ||||||||

Name |

| Age |

| Since |

| Expires |

| Director Qualifications |

| ||||||||

Robert H. Demere, Jr. | | 71 | | 2012 | | 2022 | | Mr. Demere serves as Chairman and Chief Executive Officer of Colonial Group, Inc., a private petroleum marketing company located in Savannah, Georgia. Mr. Demere has been employed by Colonial Group, Inc. since 1974. As the former President of Colonial Group, Inc., Mr. Demere has attained valuable experience in raising equity in the capital markets. Prior to working for Colonial, Mr. Demere worked as a stockbroker for Robinson-Humphrey Company. Mr. Demere served on the board of directors of Savannah Bancorp Inc. from 1989 until we acquired it in 2012. Mr. Demere’s business and personal experience, including within certain of the communities that we serve, provides our Board with useful insight. | | ||||||||

Cynthia A. Hartley | | 71 | | 2011 | | 2021 | | Mrs. Hartley retired in 2011 as Senior Vice President of Human Resources with Sonoco Products Company in Hartsville, South Carolina. Mrs. Hartley served as the Chairman of the board of trustees for Coker College in Hartsville, South Carolina. Mrs. Hartley’s leadership experience, knowledge of human resource matters, and business and personal ties with many of our market areas, provides our Board with useful insight and enhance her ability to contribute as a director. | | ||||||||

Robert R. Horger | | 69 | | 1991 | | 2022 | | Mr. Horger served as Chairman of the Company and the Bank from 1998 until the completion of the Merger on June 7, 2020. He also has served as Vice Chairman of the Company and the Bank, from 1994 to 1998. Mr. Horger has been an attorney with Horger, Barnwell and Reid in Orangeburg, South Carolina, since 1975. During his tenure as Chairman, Mr. Horger has developed knowledge of our business, history, organization, and executive management which, together with his experience and personal understanding of many of the markets that we serve, has enhanced his ability to lead our Board through challenging economic conditions. Mr. Horger’s legal training and experience also enhance his ability to understand our regulatory framework. | | ||||||||

915

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||

|

|

|

| First |

| Current |

| Nominee |

|

|

| ||||||||||||||||||

|

|

|

| Elected |

| Term |

| for New |

| Business Experience for the Past Five Years and |

| ||||||||||||||||||

Name |

| Age |

| Director |

| Expires |

| Term |

| Director Qualifications |

| ||||||||||||||||||

John C. Pollok Senior Executive Vice President | | 54 | | 2012 | | 2021 | | Mr. Pollok was appointed to serve as a Senior Executive Vice President of the Company on June 7, 2020 in connection with the Merger. Before that, Mr. Pollok served as our Chief Financial Officer from March 21, 2012 until the completion of the Merger on June 7, 2020. Before that, he served as our Chief Operating Officer from February 15, 2007 until July 19, 2018. Mr. Pollok also previously served as Chief Operating Officer of the Bank from February 15, 2007 until March 21, 2012. Before that, he served as our Chief Financial Officer from February 15, 2007 until January 3, 2010. Mr. Pollok brings to our Board an overall institutional knowledge of our business, banking industry expertise, and leadership experience. | | ||||||||||||||||||||

Kevin P. Walker |

| 68 |

| 2010 |

| 2021 |

|

|

| Mr. Walker, CPA/ABV, CFE, is a founding partner of GreerWalker LLP with offices in Charlotte, North Carolina and Greenville, South Carolina. GreerWalker LLP, founded in 1984, is the largest certified public accounting firm founded and headquartered in Charlotte and currently employs approximately 115 people. Mr. Walker is also a member of the American Institute of Certified Public Accountants, the North Carolina Association of Certified Public Accountants, the Financial Consulting Group, the Association of Certified Fraud Examiners, and the American Arbitration Association Panel of Arbitrators. Mr. Walker was first elected to our Board of Directors in October 2010. Mr. Walker’s leadership experience, accounting knowledge and business and personal experience in certain of our markets enhance his ability to contribute as a director. |

| | 69 | | 2010 | | 2021 | | Mr. Walker, CPA/ABV, CFE, is a founding partner of GreerWalker LLP in Charlotte, North Carolina. GreerWalker LLP is the largest certified public accounting firm founded and headquartered in Charlotte and currently employs approximately 125 people. Mr. Walker is also a member of the American Institute of Certified Public Accountants, the North Carolina Association of Certified Public Accountants, the Financial Consulting Group, the Association of Certified Fraud Examiners, and the American Arbitration Association Panel of Arbitrators. Mr. Walker’s leadership experience, accounting knowledge and business and personal experience in certain of our markets provides our Board with useful insight and enhance his ability to contribute as a director. | | |||||||||

| | | | | | | | | | | |||||||||||||||||||

There are no family relationships between any directors or executive officers of the Company, other than between Mr. Corbett and Stephen D. Young, our directorsSenior Executive Vice President and executive officers.Chief Strategy Officer, who are brothers-in-law.

THE BOARD OF DIRECTORS AND COMMITTEES

16

During 2018,The Company and our Board of Directors held seven meetings. Each director attended at least 75%are focused on our corporate governance practices and value independent Board oversight as an essential component of the aggregate of the total number of board meetings and the total number of meetings held by the committees of the Board on which he or she served.

There is no formal policy regarding director attendance at annualstrong corporate performance to enhance shareholder meetings, though we strongly encourage such attendance. We recognize that conflicts may occasionally arise that will prevent a director from attending an annual meeting. Allvalue. Some of our directors attendedkey corporate governance policies are summarized in the 2018 annual meeting.

Our Board of Directors maintains executive, audit, compensation, governance, and risk committees. The composition and frequency of meetings for these committees during 2018 were as follows:bullets below:

| | ||||||||||||

| Subject to approval by our shareholders at our Annual Meeting, an annually elected Board, with directors serving one-year terms | ||||||||||||

|

| with entirely independent Audit, Compensation, Governance and Nominating, and Risk Committees | |||||||||||

|

| Separate roles of Chief Executive |

|

|

|

| Officer and Executive Chairman | ||||||

|

|

|

|

|

|

| Lead Independent Director with clearly defined responsibilities | ||||||

|

|

| Opportunity for executive sessions of independent directors at each regularly scheduled Board meeting | ||||||||||

|

|

| Robust Board oversight of current and potential risks facing the Company and its business | ||||||||||

|

| Stock ownership requirements for directors | |||||||||||

|

|

|

| Directors, officers and employees are prohibited from engaging in hedging or pledging transactions | |||||||||

|

|

|

| Mandatory director retirement age of 72 years, subject to certain exceptions | |||||||||

|

|

| Annual Board self-assessment guided by Lead Independent Director and the Governance and Nominating Committee and annual Board committee performance evaluations coordinated by each committee | ||||||||||

|

|

|

| Ongoing director education | |||||||||

|

|

|

| No poison pill | |||||||||

|

|

|

| Shareholders owning 10% or more of the Company’s common stock can call a special meeting of shareholders | |||||||||

|

|

|

| ||||||||||

|

|

|

| ||||||||||

|

|

|

| ||||||||||

|

|

|

| ||||||||||

|

|

|

| ||||||||||

|

|

|

| ||||||||||

|

|

Corporate Governance Documents

10

|

|

The functions of these committees are as follows: